Excellent Solid Advice Regarding House Mortgages That Anybody Can Utilize

Article by-Lewis MygindWhen you are looking for a home it can be very stressful to everyone involved. More stress is added to the process when you are trying to get approved for a home mortgage in order to purchase your dream home. Don't worry, the following article has many great tips about getting a home mortgage that will help ease this process.

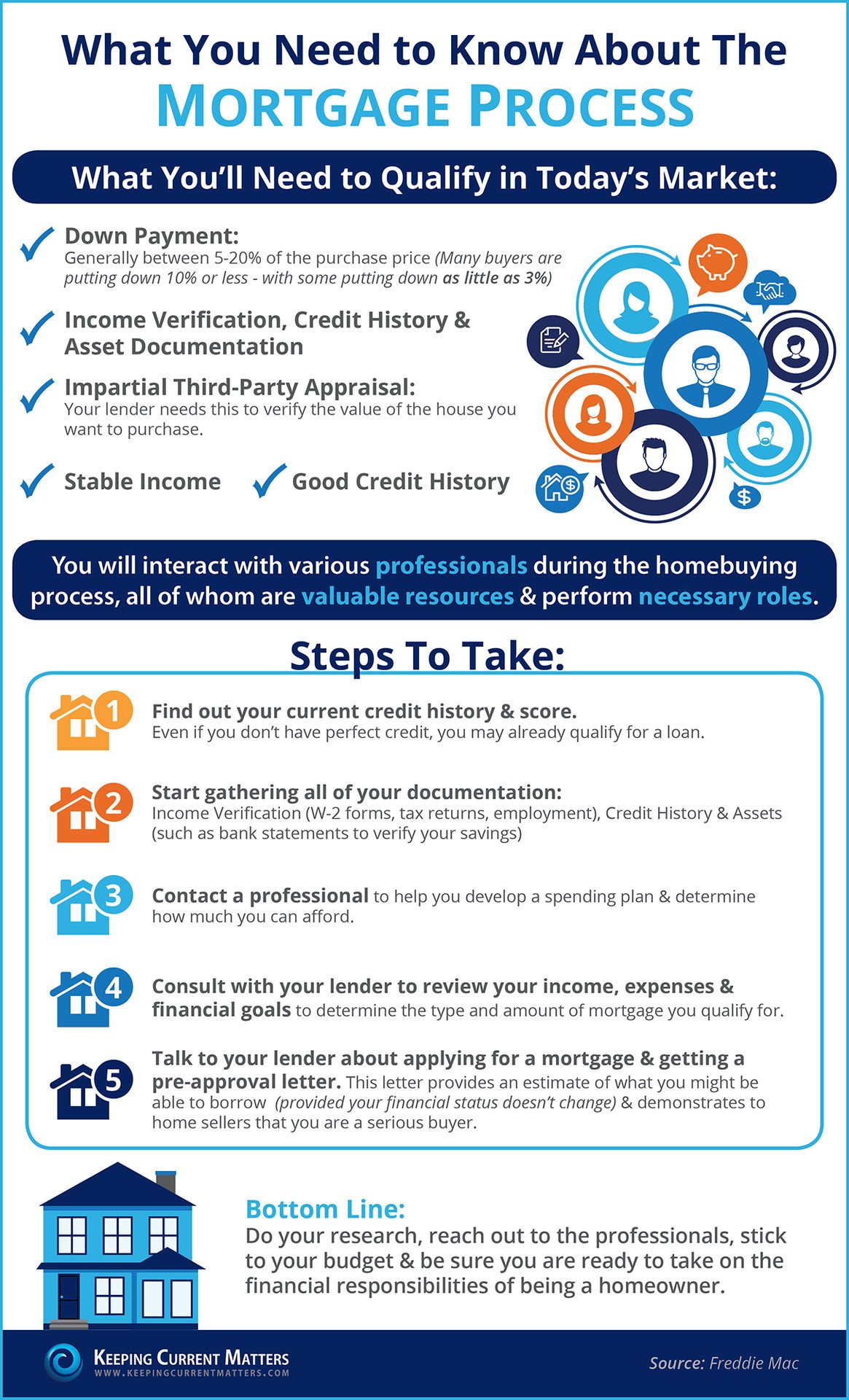

Start preparing for your home mortgage well in advance of applying for it. Get your budget completed and your financial documents in hand. This ultimately means that you should have savings set aside and you take care of your debts. Waiting too long can hurt your chances at getting approved.

Get pre-approved for a home mortgage before shopping for a new house. Nothing is worse than finding the perfect house, only to find out that you can't get approved for a mortgage. By getting pre-approved, you know exactly how much you can afford. Additionally, your offer will be more attractive to a seller.

Be prepared before obtaining your mortgage. Every lender will request certain documents when applying for a mortgage. Do not wait until https://www.globenewswire.com/news-release/2021/11/18/2336969/0/en/ABN-AMRO-intends-to-appoint-Annerie-Vreugdenhil-as-CCO-Personal-Business-Banking-and-member-of-the-Executive-Board.html ask for it. Have the documents ready when you enter their office. You should have your last two pay stubs, bank statements, income-tax returns, and W-2s. Save all of these documents and any others that the lender needs in an electronic format, so that you are able to easily resend them if they get lost.

Check with your local Better Business Bureau before giving personal information to any lender. Unfortunately, there are predatory lenders out there that are only out to steal your identity. By checking with your BBB, you can ensure that you are only giving your information to a legitimate home mortgage lender.

Make sure you know how much you can afford before applying for a mortgage. Do not rely on what your lender says you can afford. Make a budget, allowing room for any unexpected expenses. Use online calculators which can help you estimate how much mortgage you can afford to pay monthly.

Before you begin home mortgage shopping, be prepared. Get all of your debts paid down and set some savings aside. You may benefit by seeking out credit at a lower interest rate to consolidate smaller debts. Having your financial house in order will give you some leverage to get the best rates and terms.

Avoid interest only type loans. With an interest only loan, the borrower only pays for the interest on the loan and the principal never decreases. This type of loan may seem like a wise choice; however, at the end of the loan a balloon payment is needed. This payment is the entire principal of the loan.

If your home is already worth much less than is currently owed and you have had issues refinancing, keep trying. HARP is a new program that allows you to refinance despite this disparity. You should talk to your mortgage provider if you think this program would apply to your situation. You can always find a different lender if this lender won't work with you.

Some creditors neglect to notify credit reporting companies that you have paid off a delinquent balance. Since your credit score can prevent you from obtaining a home mortgage, make sure all the information on your report is accurate. You may be able to improve your score by updating the information on your report.

When trying to figure out how much of a mortgage payment you can afford every month, do not neglect to factor in all the other costs of owning a home. There will be homeowner's insurance to consider, as well as neighborhood association fees. If you have previously rented, you might also be new to covering landscaping and yard care, as well as maintenance costs.

Consider having an escrow account tied to your loan. By including your property taxes and homeowners insurance into your loan, you can avoid large lump sum payments yearly. Including these two items in your mortgage will slightly raise the monthly payment; however, most people can afford this more than making a yearly tax and insurance payment.

Never sign home mortgage paperwork that has blank spaces. Also, make sure you initial each page after you read it. This ensures that terms cannot be added after you sign. https://www.reuters.com/business/deutsche-bank-bolsters-us-healthcare-ib-unit-with-new-exec-hires-2021-08-10/ may be inclined to add pages to your contract which you did not read, and this protects you from this practice.

Understand what happens if you stop paying your home mortgage. It's important to get what the ramifications are so that you really know the seriousness of such a big loan as a home mortgage. Not paying can lead to a lower credit score and potentially losing your home! It's a big deal.

To get a good mortgage, it's important to have a good credit score. Have an idea what your credit score is, and if there are errors present you should fix them now. To get the best possible loan rate these days, a score of at least 620 is probably needed.

Avoid applying for a car loan before applying for a home mortgage. Most car dealerships send your loan application to several lenders to try to obtain financing. This can result in numerous hits to your credit report which can lower your credit score. Thus, effectively keeping you from getting the lowest interest rate, or worse, getting approval.

Look into a mortgage that requires payment every two weeks as opposed to monthly. This will let you make more payments every year, greatly reducing the amount of money you spend on interest on the life of the loan. This works well if your pay period is every two weeks since the payments can be automatically drawn from your bank.

Be aware that certain things may need to be done to the property before the loan can be approved. One such thing is extra insulation added to the home. This work can either be done by the home buyer or the homeowner. However, once the work is completed, it must be inspected by a certified inspector.

The process of obtaining a home mortgage can be a little overwhelming. Don't let that scare you away. The helpful tips shared here can give you the knowledge you need to go into the bank with your head held high with confidence. Use what you learned and you can be in a brand new house before you know it.